Category: General

Country: India

Region: Asia

In the journey to becoming the world's textile hub, India faces daunting challenges such as low cotton yield and high domestic prices. Yet, opportunities are compelling, and can be tapped with innovation, government support, and foresight.

By Pankaj Tibrewal

30th August 2024 / 15:37 IST

Founder & CIO, IKIGAI Asset Manager

India, a country with a rich heritage in textiles, is once again at the forefront of discussions on global trade. The recent political unrest in Bangladesh has opened the door for India to potentially reclaim its leadership in the global textile market. However, while the opportunity is large and tempting, the path forward is riddled with challenges that could either propel India to the top or leave it trailing behind.

A tale of two textile giants: India vs Bangladesh

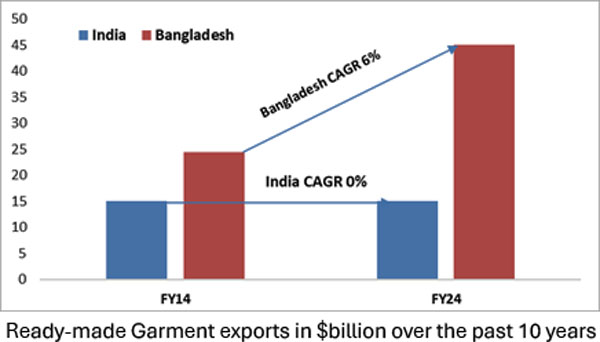

The global textile industry has been dominated by a few key players, with India and Bangladesh standing tall among them. India’s textile industry is massive, valued at approximately $150 billion, with exports contributing around $40 billion. On the other hand, Bangladesh, though smaller in size, punches above its weight with exports totalling about $45 billion, driven primarily by its ready-made garment (RMG) sector.

India’s ready-made garment exports are 1/3rd of Bangladesh at $15 billion and are almost stagnant since 2015. The competition is fierce, and while India has the scale, Bangladesh has carved out a niche with its efficiency and export-oriented approach.

Cotton conundrum: The yield problem

At the heart of India’s textile industry lies a fundamental problem -- cotton yield. India and China are the world’s largest cotton producers, each churning out around 6 million tonnes annually. But here’s where the story takes a twist. China manages this feat using just 3.2 million hectares of land, while India requires more than 13 million hectares for the same output. The maths doesn’t add up in India’s favour.

India’s average cotton yield is a meagre 460 kg per hectare, significantly lower than the global average of 780 kg per hectare (again World average is deflated due to very low cotton yield in India). Compare this to China’s Xinjiang region, where yields soar to 2,000 kg per hectare, or Brazil’s 1,800 kg per hectare, and the issue becomes glaring. Poor seed quality, fragmented land bank and outdated technology are dragging down India’s potential, and unless addressed, this could be the Achilles’ heel that undermines India’s textile aspirations.

The MSP dilemma: A blessing or a curse?

To support its farmers, the Indian government has been increasing the Minimum Support Price (MSP) for cotton, with a hike of 9 percent for the 2023-24 season and recent hike of 7.3 percent for 2024-25. While this move is well-intentioned, aiming to offset rising cultivation costs, it brings with it a host of challenges.

The increase in MSP may offer short-term relief to farmers, but it also raises questions about sustainability. Higher MSPs make Indian cotton more expensive, especially when international prices are falling. Over the past six months, global cotton prices have dropped by 30 percent, making Indian cotton less competitive in the international market.

Add to this the import duties imposed by India to protect domestic farmers, and you have a scenario where raw material costs for textile manufacturers skyrocket. This price discrepancy between domestic and international markets not only impacts profitability but also threatens India’s position in the global textile arena.

Spinning a new strategy: Impact on cotton spinning

The ripple effect of these challenges is felt most acutely in the cotton spinning industry. When international cotton prices were high, Indian yarn exports flourished. But as global prices plummeted, the tables turned. Now, with domestic cotton prices propped up by MSP and import duties, Indian yarn is struggling to find its footing in the global market.

The surplus yarn that can’t be exported is being funnelled into the domestic market, causing an oversupply that drives down prices. For Indian spinning mills, this is a double whammy -- reduced export competitiveness and shrinking margins at home. Without a strategic shift, the future looks uncertain for this critical segment of the textile value chain.

The road ahead: Challenges and opportunities

India’s journey to becoming the world’s next textile hub is far from straightforward. The challenges are daunting -- low cotton yield, high domestic prices, availability and higher prices for manmade fibres and fierce global competition. Yet, the opportunities are equally compelling. With the right mix of innovation, government support, and strategic foresight, India can weave its way back to the top.

The world is watching, and the stakes are high. Will India rise to the occasion, or will it let this opportunity slip through its fingers? The answer lies in how well it can address its internal challenges and leverage the new seeds of change being sown today. The fabric of India’s future in textiles is being woven as we speak, and only time will tell if it’s a tapestry of success.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Courtesy: Moneycontrol.com

Copyrights © 2025 GLOBAL TEXTILE SOURCE. All rights reserved.