Category: GARMENTS

Country: Bangladesh

By SOUMNYA BHOWMICK

DECEMBER 16, 2022.

Bangladesh has had a tumultuous history, from multiple natural disasters and civil wars to a rapidly developing economy on its path to competing with other Asian tigers.

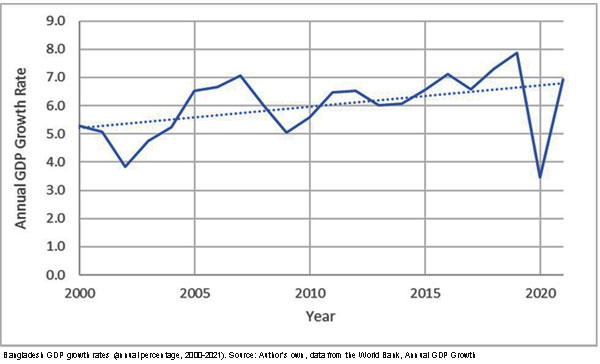

The economy has faced a long period of slow growth; from 1970 to 1980, the average annual growth rate was only around 2%. However, the progressive structural shift of the nation’s economy from an agrarian one to one focused on industry and services caused it to rise in the following years, surpassing the 5% level in 2004.

As a result, Bangladesh’s growth rate overtook Pakistan’s in comparison to its South Asian neighbors in 2006, and the economy had routinely grown by more than 6% since 2011, until the Covid-19 pandemic hit in 2020.

From more than 60% in the early 1970s to 30% in the 1990s, the agriculture sector’s share drastically decreased before stabilizing at about 12% in recent years. However, shares in the industry and services sectors are rising, which offsets this decline. Currently, industries make up around 33% of gross domestic product, while the service sector, which accounts for roughly 55% of GDP, is the largest.

From more than 60% in the early 1970s to 30% in the 1990s, the agriculture sector’s share drastically decreased before stabilizing at about 12% in recent years. However, shares in the industry and services sectors are rising, which offsets this decline. Currently, industries make up around 33% of gross domestic product, while the service sector, which accounts for roughly 55% of GDP, is the largest.

The service sector in Bangladesh saw fast expansion in the 1980s, and it continued to thrive when the economy underwent trade liberalization in the early 1990s. The rise of the service industry in Bangladesh is mainly attributed to the subsectors of wholesale and retail trade, transport, storage and communication, and financial intermediations.

However, an econometric study of 10-year data from 2000 to 2010 reveals that while the service sector has risen at a rate of 6.17%, outpacing agriculture at 3.21%, industries have grown at a higher rate (7.49%) than services. The value added by services as a share of GDP decreased by 2.2 percentage points from 2010 to 2021.

Manufacturing had strong growth rates during the 1990s and has shown an upward trend over the past 20 years, increasing its share within the realm of industries. However, according to World Bank statistics, the ready-made garments (RMG) sector is primarily responsible for manufacturing growth, with textiles and apparel accounting for about 57% of the sector’s total value added.

In contrast, the value-added share of medium- and high-tech manufacturing has steadily decreased, going from 24% in the 1990s to 7% in 2019.

RMG sector

The development of RMG coincides with the country’s unbalanced trade patterns. RMG exports make up nearly 84% of all export revenues, and they increased from US$14.6 billion in 2011 to $33.1 billion in 2019 at a compound annual growth rate of 7%.

Bangladesh’s export-oriented industrialization, which is heavily dependent on RMG, raises macroeconomic risks for the economy even though the composition of the import basket has changed from agricultural raw materials to manufactured raw materials.

The overwhelming reliance on a single category of RMG exports without expanding into more sophisticated manufactured products such as steel, chemicals, and transport equipment, among others, has contributed to the GDP share of exports falling from 20.2% in 2012 to 10.7 % in 2021.

The first leading cause for concern is the erratic nature of the global market for RMG produced in Bangladesh. The growth pattern in Bangladesh is highly vulnerable to exogenous shocks like the Covid-19 pandemic, mainly because the country is focused on producing low-value garments with insufficient diversification in either the top rungs of the same value chain or in other spheres.

In the latter half of 2019, there were indications of a downturn in this industry. When pandemic-induced lockdowns began in 2020, they exacerbated problems, including order cancellations and payment delays. Further, the Russia-Ukraine crisis, which prevented Russia from utilizing the global payments messaging network SWIFT, meant that many garment traders could not get export receipts, which reduced demand for RMG.

Second, Vietnam’s expansion in this market has posed serious competition, because Bangladesh sells more than 80% of its RMG to markets in Europe and North America. On the one hand, Bangladesh’s RMG exports to the European Union could be exceeded by the preferential trade agreement (PTA) between Vietnam and the EU, and on the other, the US has firmly picked Vietnam as a substitute for China for sourcing inputs.

US clothing imports from Vietnam were estimated to be 2.5 times Bangladesh’s exports to the US.

Third, the cost of fuel is increasing, which is a burden on the supply side of RMG, since it makes up around 10% of the expenditures absorbed by apparel companies. Additionally, the Bangladeshi economy’s inflationary pressures have driven up the input costs in RMG industries, pushing up the cost of finished goods and lowering their price competitiveness in the international markets.

In reality, with greater labor mobility among industries and regions, the RMG sector relies heavily on unskilled labor, which might not be viable in the long run.

Finally, the country’s infrastructure issues and sourcing firms’ growing preference for near-shoring pose a severe danger. In addition, the Tazreen Factory fire in 2012 and the Rana Plaza tragedy in 2013 serve as stark reminders of the appalling working conditions in Bangladesh’s textile industry, which has caused several international clients to abandon buying from Bangladesh, in view of sustainable fashion trends.

It is crucial to recognize that the anti-export bias that affects non-RMG industries also limits rivalry among export industries, which prevents product innovation.

Because of the recent deterioration of the business environment and the difficulty in obtaining financial capital, particularly for small and medium-sized firms, both export-sector diversification and infrastructure improvement in the RMG sector are hampered by inadequate private-sector investments.

Additionally, as climate change intensifies, the world’s consumer preferences are shifting even more in favor of sustainable goods. Lack of diversification and reduced spending on research and development to broaden the market for climate-neutral products might sink the nation with lower exports and a commensurate impact on other macroeconomic factors.

The author acknowledges Tushar Katiyar at the National Law School of India University in Bangalore for his research assistance on this article.

Courtesy: https://asiatimes.com/2022/12/impacts-of-garment-industry-focus-in-bangladesh/

Copyrights © 2025 GLOBAL TEXTILE SOURCE. All rights reserved.