Category: HOME TEXTILES

Country: India

Region: Asia

24th September, 2024

Synopsis

• The global home textile industry, valued at USD 122 billion in CY2023, is envisaged to reach USD 134 billion by the end of CY2024, and thereafter expected to grow at a CAGR of 5-5.5% to around USD 185 billion by 2030. China leads in home textile exports, followed by India and Turkey, with the USA being the largest importer for home textile products.

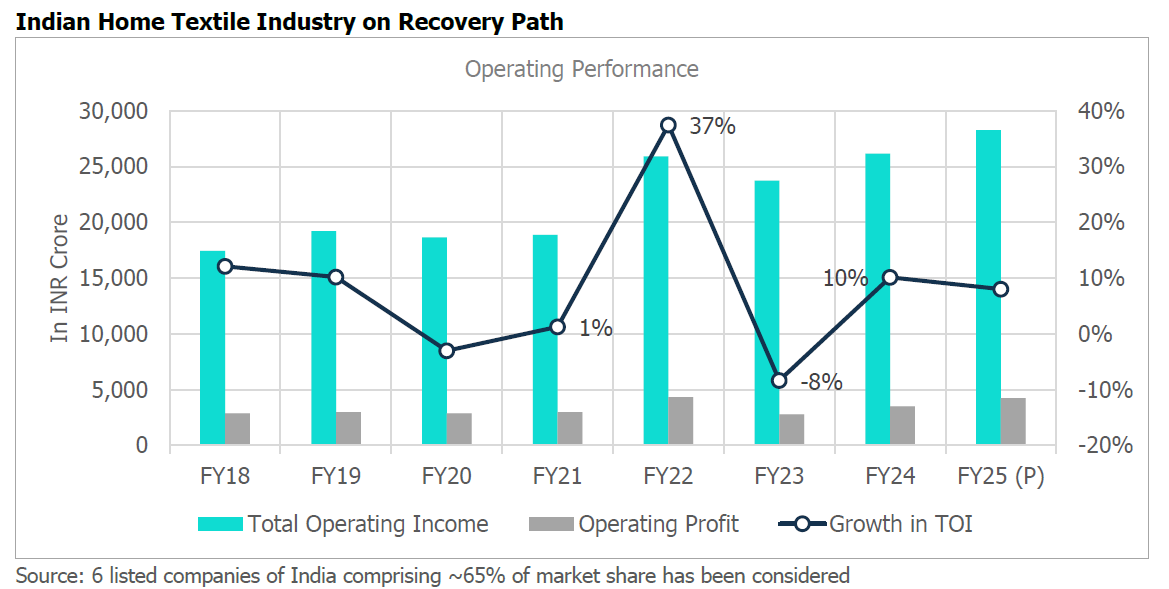

• The Indian Home Textile industry’s revenue (considering 6 listed Indian home textile companies which hold nearly 65% of domestic market share) is envisaged to grow by approximately 8 to 10% in FY25 while operating margins (PBILDT) are expected to remain in the range of 14-15%. Growth drivers such as rising per capita income, rapid urbanization, and an expanding real estate sector, along with heightened awareness of hygiene and shifting consumer preferences, are expected to contribute to revenue growth in FY25. Following the setbacks of FY23, the industry is now on a recovery path as seen in FY24.

• Given the healthy performance of the major home textile players and their plans for capacity expansion, the credit profile of Indian home textile companies is expected to remain robust, supported by strong balance sheets.

Global Home Textile Industry

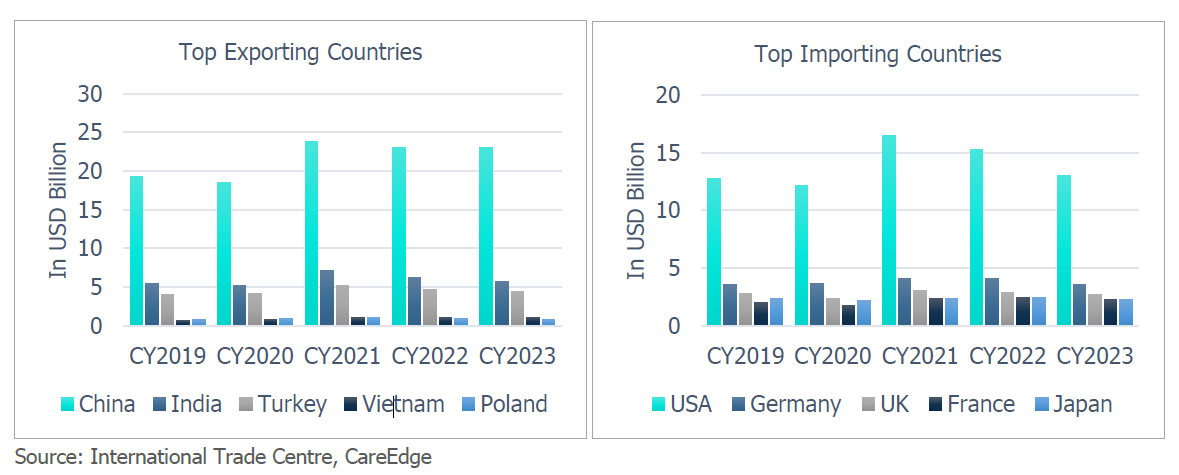

The global home textile industry was valued at USD 122 billion in CY2023 and is projected to reach USD 134 billion by the end of 2024, representing 7-8% of the overall textile industry. This sector is expected to grow at a CAGR of 5-5.5% up to 2030. China has solidified its position as the leading exporter with approximately USD 23 billion in exports in 2023, followed by India with USD 5.7 billion and Turkey in the third place with USD 4.2 billion of exports. During the COVID-19 pandemic, India’s exports surged to USD 7.1 billion due to sudden increase in demand from the US and Europe, driven by heightened hygiene concerns, enhanced stocking by retailers to guard against any supply disruptions due to the pandemic and the China+1 strategy.

On the import side, the USA stands out as a very significant player, accounting for about 30% of global home textile imports, with European countries like Germany, the UK, and France importing approximately 8%, 6%, and 5%, respectively. For USA, China remains the dominant supplier, providing around 35% of home textiles, while India holds the second spot with approximately 29%. Over the period of CY19 to CY23, India’s exports have grown by 12.27%, while China has declined by 13.2%, indicating a shift from China to India. In the UK market, India faces more competition, with China leading at 23% of imports, followed by Pakistan at 20%, and India at 10%.

Indian Home Textile: Weaving Steady Growth

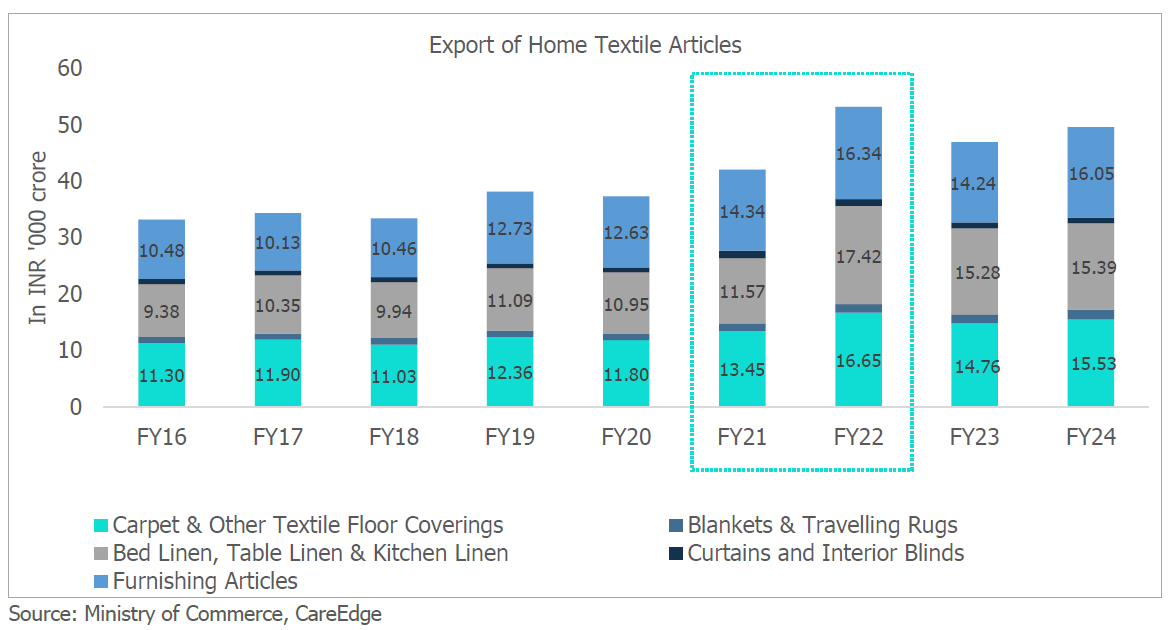

The Indian home textile industry, accounting for nearly 7-8% of the global market, ranks among the top suppliers to the US. With its quality offerings, Indian home textile companies have established themselves as prominent suppliers to both the US and UK markets. Carpets, rugs, and furnishing articles make up approximately 30-32% of total home textile exports, followed closely by bed linen and kitchen/table linen.

From FY16 to FY20, the home textile industry experienced steady export growth. However, during COVID-19 the sector truly thrived. While many industries struggled, home textiles saw unprecedented growth starting from FY21, wherein the sector achieved a 13% year-over-year (yoy) growth. The peak came in FY22, with a dramatic 26% yoy increase. This surge was driven by pandemic-induced demand and the China+1 strategy.

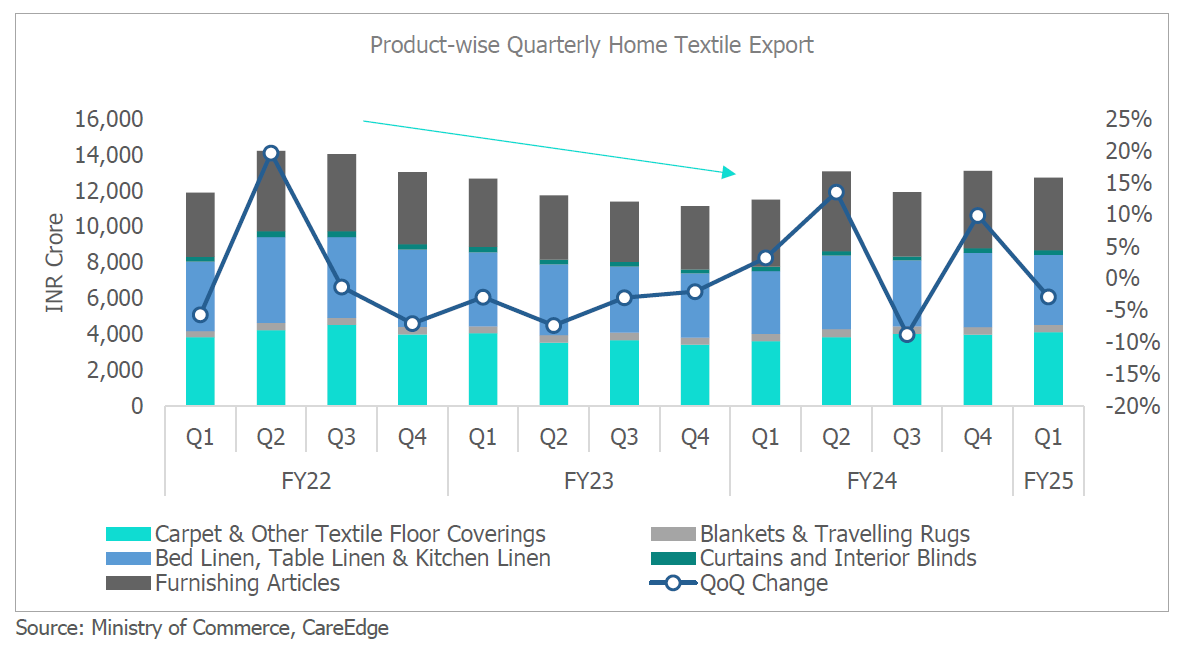

Following a peak in demand during the second and third quarters of FY22, the home textile industry faced significant challenges. The surge in demand from Western countries led to a sharp increase in raw material prices, especially cotton, and higher freight costs due to prolonged pandemic lockdowns.

Additionally, economic scenario in USA and UK, rising energy costs in the EU, exacerbated by the Russia-Ukraine conflict, reduced discretionary spending in these markets. These factors caused exports to plateau in Q3 FY22 and decline from Q4 FY22 onwards. Home textile exports consistently decreased each quarter, culminating in a 12% y-o-y decline in FY23. From a peak of ₹14,200 crore in Q2 FY22, exports fell to ₹11,200 crore by Q4 FY23. However, the story changed as exports picked up from Q1FY24 and continued its growth momentum showing an improving trend. The global market saw a significant boost, driven primarily by the US market, leading to notable recovery after several quarters of decline.

Raw Material Price Trends – Added to the Woes

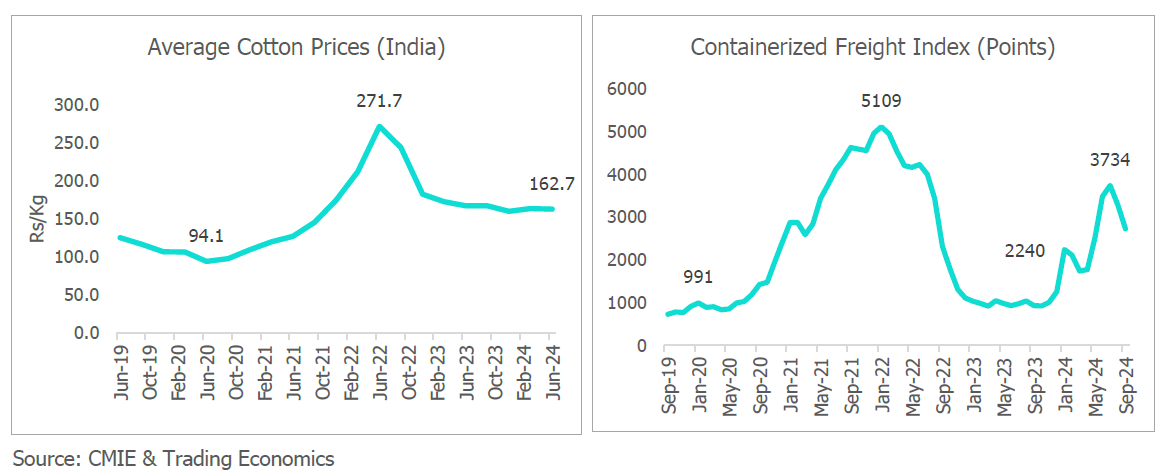

Cotton, the primary material for bed linen, is crucial for the profitability of home textile companies. In June 2022, cotton prices soared to around ₹1,00,000 per candy (₹272 per kg) due to low-yield crops in several states. However, as the global economy slowed and demand weakened, it caused a sharp price correction in cotton prices starting in December 2022. Since then, cotton prices have stabilized between ₹160-₹164 per kg.

In addition to cotton prices, higher freight costs significantly impact profitability. Historically volatile, these costs surged following the Russia-Ukraine war, with oil prices exceeding $110 per barrel in May 2022. Having significantly fallen thereafter, the ongoing Red Sea crisis from the start of 2024 has again increased shipping costs for Indian exporters, as approximately 95% of vessels now re-route around the Cape of Good Hope, extending transit times by 14-20 days and increasing logistics cost by nearly 4-5 times.

In FY22, the select set of home textile manufacturers saw significant growth, with total operating income (TOI) increasing by over 37% year-on-year. This growth was primarily driven by higher exports to the US and EU, along with increased price realizations for home textile products. Operating margins peaked at 17% in FY22. However, post-FY22, the industry faced a substantial decline in total sales due to reduced demand from Western economies, particularly as the US grappled with inflation and the UK with deflation.

This reduced demand, coupled with higher cost cotton inventory, elevated freight costs, and inventory write-offs, led to a 491-basis point decline in operating margins, bottoming out at 9% in Q2 FY23, exactly one year after their peak in Q2 FY22. Despite this downturn, the industry gradually started to show signs of recovery from Q3 FY23 onwards, driven by increased domestic demand and a gradual recovery in exports.

CareEdge View

“The global home textile industry is set to grow at an annual rate of 5-5.5% by CY30, driven by higher disposable income, mushrooming real estate market, and a greater focus on hygiene post-COVID. There’s also a notable shift towards sustainable and eco-friendly products, which is expected to significantly influence the industry’s development. Indian home textile industry after experiencing difficulties in FY23, led by demand slowdown from key importing countries, increased raw material prices and high freight costs, has recovered sharply in FY24. Going forward the industry is anticipated to grow by 8-10% in FY25, bolstered by stable raw material prices and improved demand from key importing countries. Despite challenges such as elevated freight costs and geopolitical tensions, the industry is expected to maintain operating margins in the range of 14-15% in FY25,” said Arti Roy, Associate Director, CareEdge Ratings.

“The global home textile industry is set to grow at an annual rate of 5-5.5% by CY30, driven by higher disposable income, mushrooming real estate market, and a greater focus on hygiene post-COVID. There’s also a notable shift towards sustainable and eco-friendly products, which is expected to significantly influence the industry’s development. Indian home textile industry after experiencing difficulties in FY23, led by demand slowdown from key importing countries, increased raw material prices and high freight costs, has recovered sharply in FY24. Going forward the industry is anticipated to grow by 8-10% in FY25, bolstered by stable raw material prices and improved demand from key importing countries. Despite challenges such as elevated freight costs and geopolitical tensions, the industry is expected to maintain operating margins in the range of 14-15% in FY25,” said Arti Roy, Associate Director, CareEdge Ratings.

Courtesy: careratings.com Cover Image: Trident Group

Copyrights © 2026 GLOBAL TEXTILE SOURCE. All rights reserved.