Category: FABRICS

Country: India

Region: South Asia

By M Soundariya Preetha

24th December, 2023 07:00 am

Updated 10:14 am IST

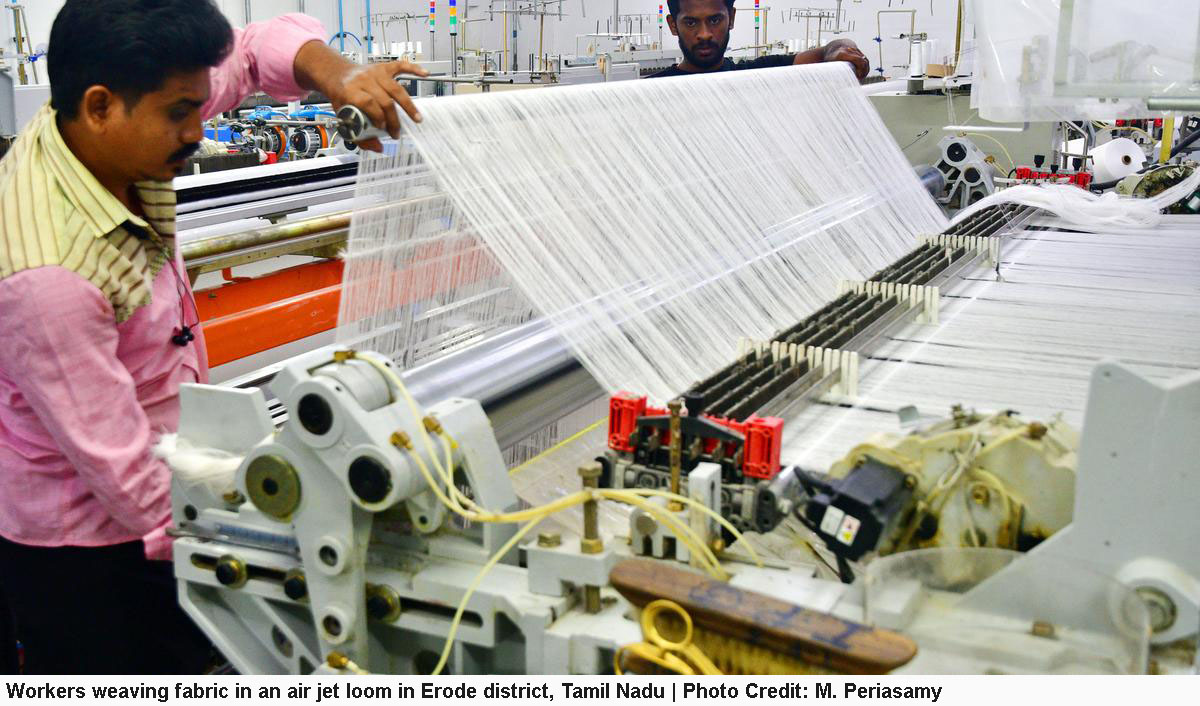

Coimbatore: For almost a year now, India’s major textile hubs of Ludhiana, Surat, and Erode have been fighting an almost insurmountable challenge: rising imports, or arguably large-scale dumping, of man-made fibre (MMF) fabrics that is affecting a sector valued at about $60 billion.

Rajesh Bansal, a fabric processor in Ludhiana, took his friends from Nagpur recently to a retail outlet to buy fleece. “Of the six pieces shown to us, four were from China,” he says.

“China dumps fabric and this creates problems,” asserts Ashok Jirawala, president of the Federation of Gujarat Weavers Association. “We ran our weaving units to full capacity and now we have unsold stocks. So, we plan to cut production by 20%.”

C. Jaganathan, who weaves fabrics in Erode, imports viscose yarn from China. “When the prices were ₹180 a kg for Indian yarn, I got it for ₹125 a kg from China. Only for the last one month Chinese prices are higher. The Chinese sellers are now offering the current price for a year,” he observes.

In the last three years, MMF fabric imports, which attract mostly 20% duty, have doubled and most of it is knitted synthetic fabrics, contends R.K. Vij, secretary general of the Polyester Textile Apparel Industry Association.

According to data shared by Mr. Vij, in 2019-2020 (April to March), about 325 tonnes of fabric were imported every day from China at $4.61 a kg. The volume increased to 887 tonnes a day in the April-June quarter of this fiscal and the average value was about $2.90 a kg. Of this, value of knitted or crocheted dyed fabrics made of synthetic fibre was just $1.4 (about ₹118) a kg.

‘Under invoicing hurts’

It is not just imports, but “under invoicing of imported finished fabrics that is a major issue,” notes Mr. Vij. “The government should issue a notice to Customs, stopping clearance of fabrics that are priced below a certain value at the ports,” he urges.

A worker processing yarn at a sizing unit in Erode district, Tamil Nadu | Photo Credit: PERIASAMY M

Rising import of MMF fabric and relatively higher domestic prices of MMF fibres are severely impacting local spinners, knitters, weavers and processors as they are unable to supply at competitive prices. This has hit both, the local and export manufacturers, and the downstream industry is said to be operating at only 70% capacity.

Quick trade estimates for November from the Confederation of Indian Textile Industry (CITI) show that export of man-made yarn, fabrics, and made-ups were 7.33% lower year-on-year. For April-November, the decline was 23.2%.

In 2017-18, fabrics dominated India’s total MMF exports with 33% share, while yarn made up 32%, as per a study on the Ministry of Textiles website. India’s share in global MMF trade was 2.7% in 2019.

“Indian textiles is predominantly cotton based,” says a Tamil Nadu-based viscose products producer, who spoke on condition of anonymity. “We could not bring much innovation in MMF products. China, Thailand, Korea have been the innovators,” he adds.

“We were out-priced on the raw material front for the last 15 years. We do small value additions. With the China + 1 strategy, there is a big push from western brands but we do not have the capabilities. China is the biggest player in MMF. It is desperate to sell its raw material at any cost as its customers are looking at other countries for sourcing it. China determines the international prices.”

The viscose products producer says, given China’s dominance, India’s introduction of Quality Control Orders (QCOs) on MMF fibres is severely impacting the entire value chain.

The government has introduced QCOs on polyester raw materials, polyester fibre and yarn, and viscose fibre, making Bureau of Indian Standards (BIS) certification mandatory for these products, even if they are imported.

‘QCOs killing industry’

“The QCOs are killing the industry,” says Rakesh Mehra, Chairman, CITI. “The government should have started with QCOs for garments. That is left open [for imports] and it has introduced QCOs for fibre. This has led to fibre prices going up. What should be of good quality is what touches the skin. But, that [garment and fabrics] is imported without any quality control. One has to do a deep study on the prices and imports. The industry is for QCOs and good quality, But, it should be introduced first at the garment stage,” adds Mr. Mehra.

And, this is a view echoed by most of the MMF players that The Hindu spoke to.

Any textile mill that produces MMF yarn (polyester or viscose) should get the yarn tested for BIS standards. “How can a small-scale mill spend lakhs on testing,” asks a small-scale textile mill owner, speaking on condition of anonymity. “It should not be mandatory at the yarn stage,” he adds.

By extension, quality control on fibre imports is denying the market of high quality fabrics.

A viscose yarn producer says a garment exporter in Tiruppur showed a sample that he claimed was a branded speciality fabric. On closer examination, it turned out to be a blend of nylon and viscose. “No one really checks. The sellers are using brand names to push any type of blended fabric into the market,” adds the yarn producer, who does not wish to be identified.

In a slow market, the imports and QCOs on fibre seem only to drag down the industry, not just the MMF sector but the promising technical textiles segment too.

The industry is unable to import MMF fibres under advance authorisation scheme for overseas orders where the customers specify the speciality fibres to be used. “There is no clarity on this and it is leading to a lot of confusion,” says the Synthetic and Rayon Textiles Export Promotion Council chairman Bhadresh M. Dodhia. “The surge in import of value added products is ridiculously high. QCOs should be implemented across the value chain at the earliest,” he adds.

MSMEs on edge

Almost a year of declining orders and high prices have put MSME units’ finances on edge.

“I weave rayon fabric and sell it to local traders who sell in the north Indian markets,” says Aruchamy, a weaver in Palladam who owns and operates automated looms.

“The buyers have reduced the prices by ₹2 to ₹5 a metre in the last one year. For every three looms, there should be one worker. I now have one person to man five looms. A fitter asks for ₹30,000 a month as salary. I cannot afford it. This affects the quality of the fabric produced,” he adds.

“I used to pay ₹4 lakh a month as electricity charges for the auto looms unit,” says Mr. Jaganathan. “That has increased to ₹6 lakh now. Similarly, labour costs have shot up too. In Erode, auto loom units should pay almost ₹1,000 a day to a worker,” he adds.

He is among the MMF weavers in Erode who are demanding reimbursement of GST paid under an inverted duty structure for a year so they get some financial relief.

When GST was introduced in July 2017, MMF fibre and yarn were levied 18% duty and fabric was 5%. From November 1, that year, the tax on yarn was reduced to 12%. The weavers assumed that they would get a refund for the higher duty that they have been paying. But, a good two years later, in January 2019, weavers were told that the refund would take effect only from August 1, 2018, a whole year after they had paid higher taxes. And that the refund would be on the condition that the weavers did not owe any outstanding GST for the concerned taxation period of 13 months, failing which, an 18% penalty was levied on the entire 13 months GST value. As the weavers had been hopeful of getting the refund, they had not updated their accounts to reflect the changed taxation and ended up paying the penalty to get their refund.

Mr. Jaganathan contends he should get ₹50 lakh as refund for the 13 months.

“There are many weavers who had to shut operations because of the GST issue,” says B. Kandavel, organising secretary of Federation of Tamil Nadu Powerlooms Associations.

Across the country, the government may have to pay ₹1,000 crore, or so as refund to the MMF weavers. This will be a significant financial relief to the weavers, adds Mr. Kandavel.

(This is the third of a four part weekly series looking at India’s $150-billion textile sector, and the nation’s second largest employer)

Courtesy: www.Hindu.com

Copyrights © 2025 GLOBAL TEXTILE SOURCE. All rights reserved.