Category: General

Country: India

Region: Asia

06 March 2025

Reading Time: 7 min

Why in News?

India’s textile industry has the potential to become a global leader, driven by a growing domestic market, and rising global interest.

However, key issues such as high production costs, fragmented supply chains, and sustainability challenges have slowed growth and exports.

What are the Key Facts About India’s Textile Industry?

Economic Contribution: The textile industry contributes 2.3% to India's Gross Domestic Product (GDP), projected to reach 5% by 2030.

-As of FY24, it accounts for 13% of industrial production, 12% of exports, and employs 4.5 crore workers.

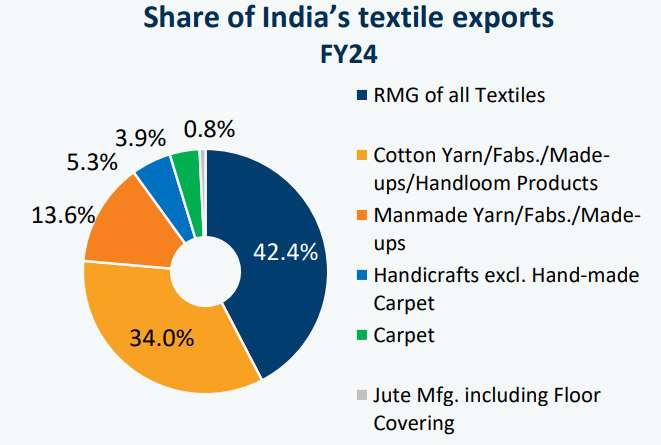

-In FY24 exports stood at USD 35.9 billion, with key markets in the US, EU, and UAE.

Position in Global Textile Trade: India has the 2nd largest textile manufacturing capacity globally and ranks as the 6th largest exporter of textiles and apparel in 2023 (accounting for 3.9% of global trade).

-India is the 2nd largest producer of cotton in the world (23.83% of world cotton production), with production expected to reach 7.2 million tonnes by 2030.

-India is the largest producer of jute in the world, and 2nd largest producer of man-made fibres (MMF), including polyester, viscose, nylon, and acrylic.

Market Growth Projections: India’s textile and apparel market is projected to reach USD 350 billion by 2030.

Government Initiatives: PM Mega Integrated Textile Region and Apparel (MITRA) Parks, Production Linked Incentive (PLI) Scheme for Textiles, National Technical Textile Mission (NTTM).

-100% Foreign Direct Investment (FDI) allowed in textiles under the automatic route to attract foreign investment.

What are the Key Challenges Facing India’s Textile Industry?

Lack of Trade Agreements: Countries like Vietnam and China benefit from Free Trade Agreements (FTAs) with major markets, making its exports more competitive.

-India lacks similar FTAs in key textile-consuming regions like the US.

Stagnant Growth and Declining Exports: Textile sector contracted by 1.8% annually (FY20-FY24), while apparel sector shrank by 8.2% per year.

-Apparel exports fell from USD 15.5 billion in FY20 to USD 14.5 billion in FY24.

Expensive Raw Materials: Government-imposed Quality Control Orders (QCOs) restrict imports of polyester and viscose, forcing domestic yarn makers to rely on costlier local alternatives.

-Polyester fibre in India is 33-36% costlier than in China, while viscose fibre is 14-16% more expensive.

Low Export Competitiveness:

India's textile exports are costlier than those of China and Vietnam due to supply chain integration issues.

-Unlike vertically integrated supply chains (company takes ownership of suppliers) in China, India's fragmented supply chain spread across states and complex customs increase logistics costs and reduce competitiveness.

-Additionally, Bangladesh, as a Least Developed Country (LDC), enjoys duty-free exports, gaining a cost advantage over India in many markets due to preferential trade policies.

Sustainability Pressures: Global brands are enforcing strict environmental norms, requiring higher renewable energy use, waste recycling, and traceability of raw materials.

-The European Union has implemented several regulations (2021-2024) covering the fashion industry, impacting nearly 20% of India’s textile exports.

Note: The global textile and garment sector contributes 6-8% of global carbon emissions (~1.7 billion tonnes/year).

Textile production causes 20% of global water pollution from dyeing and finishing and the textile sector was the 3rd largest source of water degradation and land use in 2020.

Way Forward

Strengthening Supply Chains: Develop Vertically Integrated Textile Parks that cover the entire production cycle from fibre to finished apparel, reducing logistical and production costs.

-Reassess QCOs on polyester and viscose fibres to allow controlled imports and lower domestic costs.

-Develop "fibre-to-fashion" hubs to reduce fragmentation and logistics costs.

Leveraging Labour Pools: More PM MITRA parks should be established in Uttar Pradesh, Bihar, and Madhya Pradesh, where job demand is high.

-Housing near factories, similar to China’s model, can increase productivity, and improve take-home salaries and reduce attrition rate.

Policy Reforms: Secure preferential trade agreements with EU, US, and key markets to improve competitiveness.

Boosting MMF: Encourage higher domestic MMF consumption by offering incentives for MMF-based textile production.

Sustainability: Provide financial incentives to MSMEs for shifting to sustainable manufacturing and renewable energy adoption.

-Fast fashion waste is projected to reach 148 million tonnes by 2030, driving increased demand for recycled textiles, a market where India has significant potential, strengthening waste management infrastructure will be key to sustainable growth.

Courtesy: drishtiias.com

Copyrights © 2025 GLOBAL TEXTILE SOURCE. All rights reserved.