Category: General

Country: India

Region: Asia

The Textile & Apparel 360° Report 2024, released by Groyyo Consulting, offers a sweeping analysis of the T&A industry, spotlighting transformative trends and India’s growing stature in this dynamic sector. The report delves into India’s dual role as both a rising exporter and importer, highlighting mixed performance trends and key growth drivers.

By Vaishnavi Gupta

Assistant Editor, IndianRetailer.com & Retailer Media

17th December, 2024

Reading time: 10 min

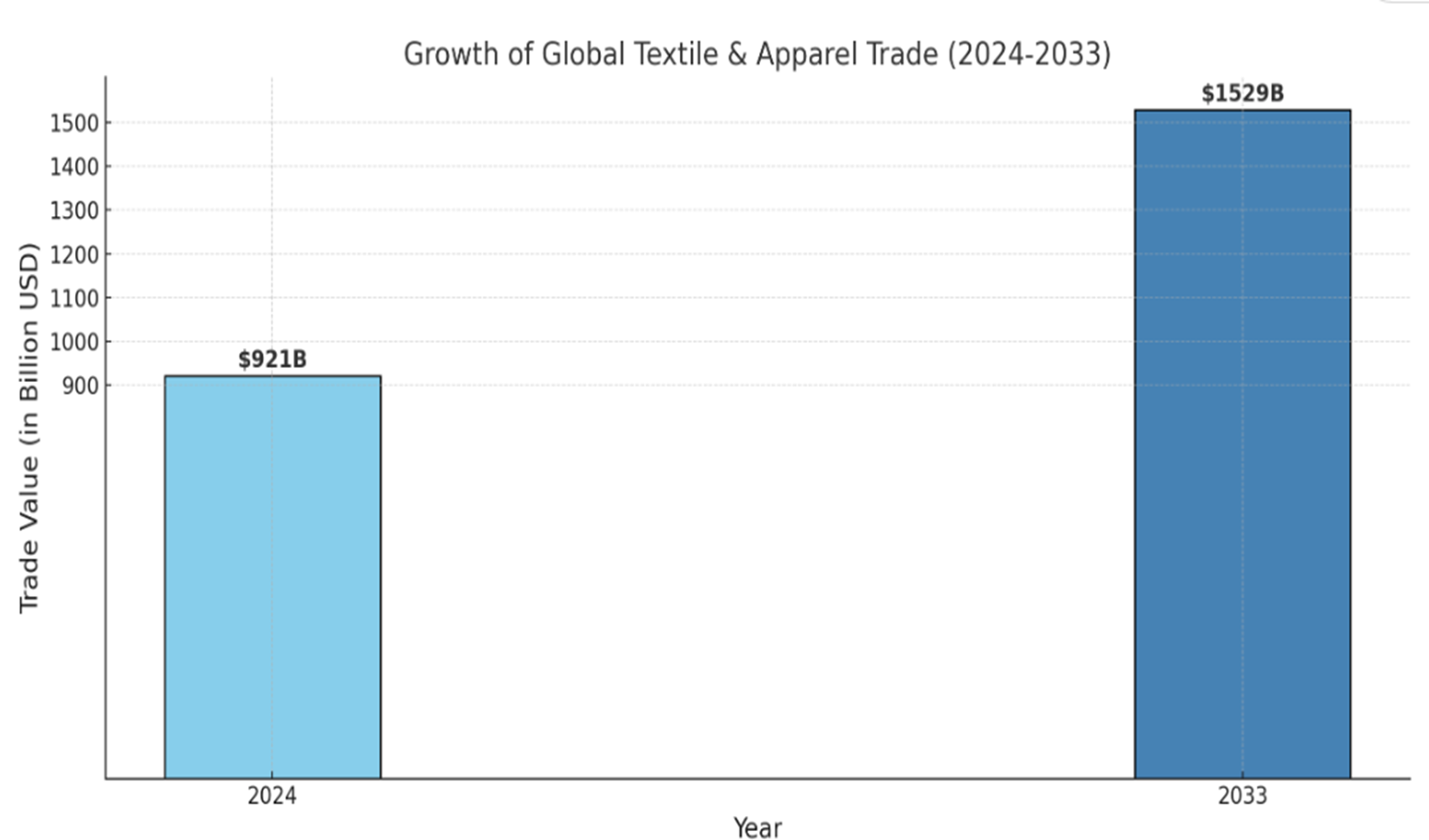

The global textile and apparel (T&A) industry is projected to expand at a compounded annual growth rate (CAGR) of 5.8 percent to reach $1.53 trillion by 2033. India is at a critical juncture in the global T&A landscape, poised to harness its vast potential as a leading textile hub.

The Textile & Apparel 360° Report 2024, released by Groyyo Consulting, offers a sweeping analysis of the T&A industry, spotlighting transformative trends and India’s growing stature in this dynamic sector. The report delves into India’s dual role as both a rising exporter and importer, highlighting mixed performance trends and key growth drivers.

Global Landscape of Textile & Apparel Trade

The global T&A market is experiencing unprecedented growth, fueled by evolving consumer demands, technological advancements, and sustainable practices. China continues to dominate the landscape, contributing 30 percent of global apparel trade, with exports worth $154 billion in 2023. Meanwhile, the EU-27 remains the largest importer, accounting for 41 percent of readymade garment (RMG) imports, with import values at $183 billion. The US follows as the second-largest importer, with imports worth $82 billion.

Regional Export Powerhouses

China’s leadership in yarn and fabric exports remains unchallenged, but nations like Bangladesh and Vietnam are carving significant niches in apparel exports. Regional partnerships and supply chain optimizations are becoming pivotal, unlocking growth potential across value chains. Bangladesh, for instance, has leveraged its competitive manufacturing capabilities and preferential trade agreements to solidify its position as a global apparel hub.

Shifts in Global Supply Chain Dynamics

The report underscores the growing importance of regional trade agreements and nearshoring trends. Countries are rethinking their supply chain strategies, emphasizing resilience and efficiency amid geopolitical shifts and post-pandemic recovery. These developments present significant opportunities for emerging markets to capture larger shares of global trade.

Export Highlights

India’s share in global T&A exports currently stands at 4 percent. While the nation has demonstrated growth in yarn (2 percent) and fabric (1 percent) exports between 2019 and 2023, fiber exports have declined by 4 percent over the same period. This dip is expected to reverse as Indian manufacturers tap into improving export opportunities. Indian apparel exports primarily cater to markets like the US, UK, and UAE, emphasizing the need for diversification into newer geographies.

Import Shifts

India’s import patterns reveal an intriguing narrative. Textile yarn imports surged by 11 percent between 2019 and 2023, driven by growing demand for synthetic fibers and fabrics. Conversely, fiber imports declined by 5.6 percent, reflecting increasing domestic production capabilities. Government policies, including anti-dumping duties, have been instrumental in protecting homegrown industries and reducing dependency on imports.

Growth Prospects and Policy Impact

India’s “Make in India” initiative is driving transformative growth in the T&A sector, bolstered by the Production Linked Incentive (PLI) Scheme. This policy encourages the production of man-made and technical textiles, enhancing export capabilities and reducing import dependency. Furthermore, the strategic emphasis on digital capacity building for Small and Medium Enterprise (SME) manufacturers is fostering innovation, improving efficiency, and enabling inclusive growth. Initiatives like these are vital for positioning India as a regional hub for sustainable and technical manufacturing.

Key Trends Shaping the Global T&A Industry

The report identifies several pivotal trends that are reshaping the global T&A sector:

1. Sustainability as a Core Strategy: With growing consumer awareness and regulatory pressures, sustainability is no longer optional. Brands and manufacturers are prioritizing eco-friendly materials, ethical sourcing, and circular fashion practices. Countries like India are uniquely positioned to lead this movement, with initiatives aimed at sustainable cotton production and waste reduction in textile manufacturing.

2. Localization and Regional Collaboration: Localization is emerging as a key strategy, with nations focusing on strengthening regional supply chains to mitigate risks and enhance efficiency. India’s proximity to major markets like the Middle East and Africa offers significant advantages, enabling faster turnarounds and reduced logistics costs.

3. Innovation in Technical Textiles: Technical textiles are gaining traction across sectors, from healthcare to automotive and infrastructure. India’s investments in research and development (R&D) and the establishment of technical textile parks are creating new opportunities for growth and innovation in this high-value segment.

4. Digital Transformation: Digitalization is revolutionizing the T&A sector, from predictive analytics in inventory management to AI-driven design processes. Indian manufacturers are increasingly adopting digital tools to enhance operational efficiency and cater to global markets effectively. Digital capacity building, particularly for SMEs, is a crucial enabler of this transformation.

5. Shifts in Consumer Preferences: Evolving consumer preferences are driving demand for customization, transparency, and sustainability. Brands are leveraging data analytics to understand and respond to these trends, creating tailored offerings that resonate with modern consumers.

Industry Leaders Weigh In

Commenting on the findings, Pratik Tiwari, Co-Founder of Groyyo remarked, “This report demonstrates India’s increasing integration into the global textile ecosystem, offering significant opportunities for businesses to tap into new markets and drive sustainable growth.”

Abhishek Yugal, Managing Partner at Groyyo added, “The global textile industry is evolving rapidly, and India has the opportunity to emerge as a leader by focusing on high-value products and sustainable practices. By leveraging digital technologies and capitalizing on government initiatives, Indian manufacturers can achieve significant growth in exports and redefine their role in the global supply chain.”

Navigating Challenges and Unlocking Opportunities

While the growth prospects are promising, the industry faces challenges, including rising raw material costs, labor shortages, and environmental concerns. Addressing these issues requires collaborative efforts from stakeholders across the value chain.

1. Enhancing Competitiveness: India must focus on improving productivity and quality standards to compete with established players like China, Bangladesh, and Vietnam. Investments in skill development and infrastructure are critical to achieving this goal.

2. Scaling Sustainable Practices: Sustainability should be integrated into every aspect of the value chain, from sourcing raw materials to manufacturing and distribution. Collaborative initiatives involving governments, brands, and NGOs can drive meaningful progress.

3. Diversifying Export Markets: Expanding into non-traditional markets is essential for reducing dependency on key regions like the US and EU. India’s strategic ties with Africa, Southeast Asia, and Latin America offer untapped growth potential.

A Roadmap for the Future

As the global T&A market races toward $1.5 trillion, India’s ability to adapt, innovate, and lead will determine its success in this rapidly evolving landscape. With robust policies, strategic investments, and a commitment to sustainable practices, the nation is well-positioned to redefine its role in the global textile and apparel trade.

Courtesy: Indianretailer.com

Copyrights © 2025 GLOBAL TEXTILE SOURCE. All rights reserved.