Category: YARNS

Country: India

The buyout of Shubhalakshmi Polyesters comes after it acquired Alok Industries and Sintex Industries; analysts see an opportunity in forward integration

Krishna Gopalan, Sep 12, 2022 | Updated Sep 12, 2022, 3:11 PM IST

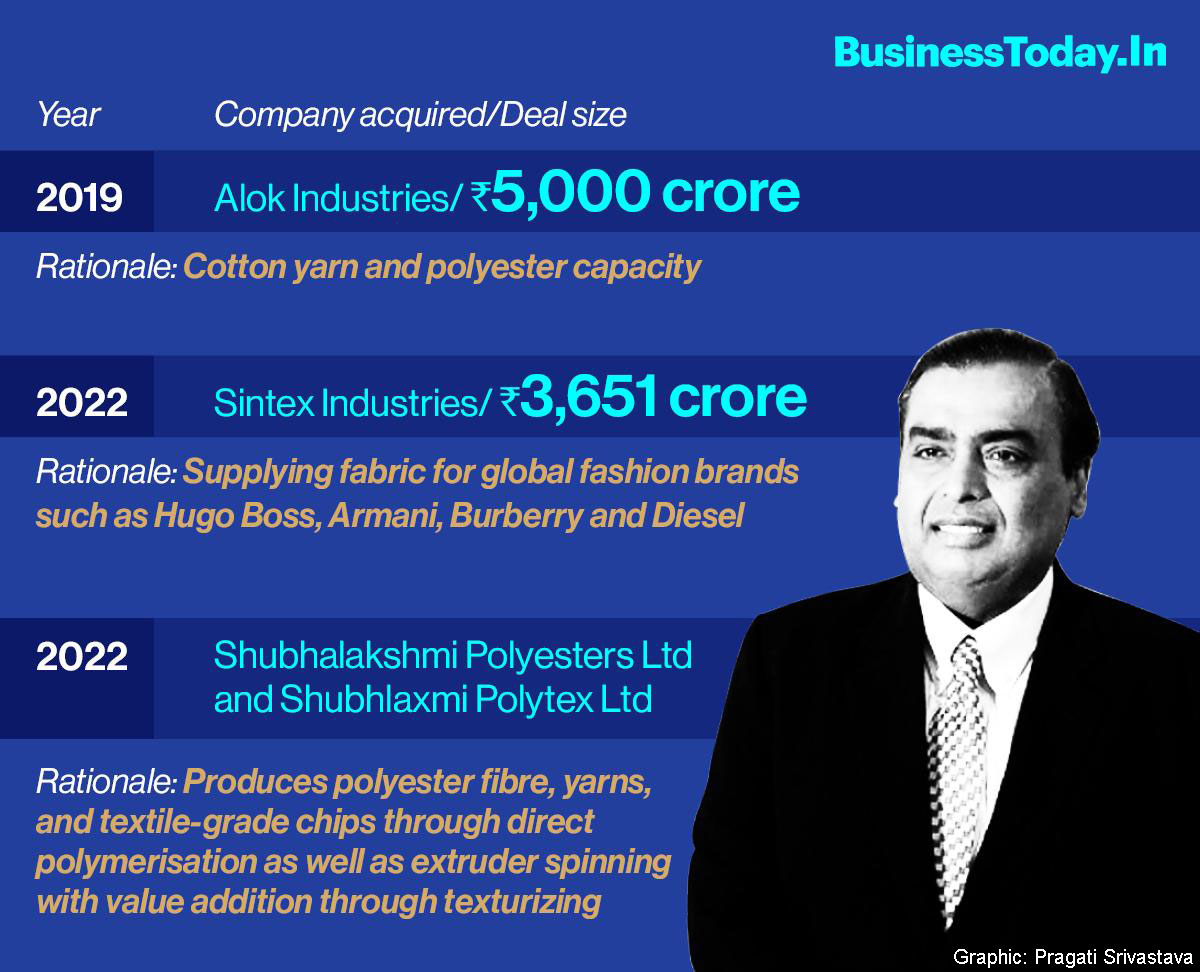

Reliance Petroleum Retail, a subsidiary of Reliance Industries Limited (RIL), has enhanced its presence in its textiles business. Through the acquisitions of the polyester business of Shubhalakshmi Polyesters Ltd (SPL) and Shubhlaxmi Polytex Ltd (SPTex) for Rs 1,522 crore and Rs 70 crore respectively, it has made a significant move. Aggregating Rs 1,592 crore, this was done by way of “slump sale on a going concern basis”, according to a company statement.

The buyouts are in line with the company’s strategy to expand its downstream polyester business. The statement outlined that SPL produces polyester fibre, yarns, and textile-grade chips through direct polymerisation as well as extruder spinning with value addition through texturizing. The company has a continuous polymerisation capacity of 2,52,000 mt per year. This is spread across two production facilities – one each in Dahej (Gujarat) and Silvassa (Dadra and Nagar Haveli). The plant in Dahej, run by SPTex, is for the production of texturised yarn.

According to Deven Choksey, MD, K R Choksey Securities, the overall textile business is now more specialty-driven. “That means, one sees a higher level of focus on inputs as we see conventional textiles existing with the growing strength of environmental textiles and industrial textiles,” he says.

This is not the first buyout that RIL has made in the textiles business. In 2019, RIL and its partner, JM Financial ARC, acquired the insolvent Alok Industries for Rs 5,000 crore when its loans stood at Rs 30,000 crore, that it owed to 27 banks. At the time of the deal, Alok Industries had a factory each in Silvassa, Vapi, Navi Mumbai and Bhiwandi, with a capacity to produce 68,000 tonnes of cotton yarn and 1.7 lakh tonnes of polyester annually.

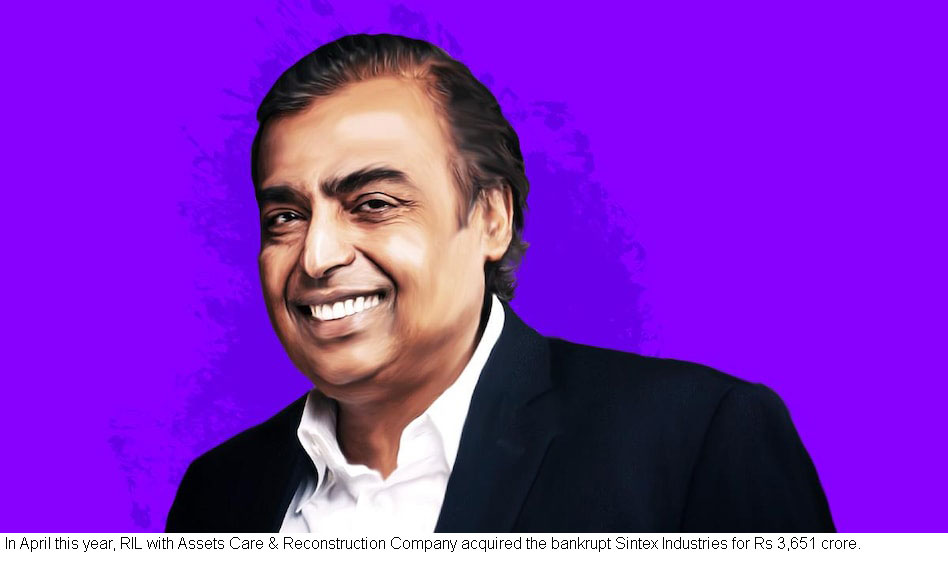

In April this year, RIL with Assets Care & Reconstruction Company acquired the bankrupt Sintex Industries for Rs 3,651 crore. Sintex was supplying fabric for a host of global fashion brands among which are Hugo Boss, Armani, Burberry and Diesel. Likewise, both SPL and SPTex, have between FY19 and FY21, faced a scenario of declining revenue.

The turnover of SPL for FY 2019, FY 2020 and FY 2021 was Rs 2,702.50 crore, Rs 2,249.08 crore and Rs 1,768.39 crore respectively and turnover of SPTex for FY 2019, FY 2020 and FY 2021 was Rs 337.02 crore, Rs 338.00 crore and Rs 267.40 crore, respectively. “Reliance is looking at strategic assets to grow the business. While they may seem small, it helps in building an entity with scale. Over time, the smaller companies in textiles will find it hard to grow,” says another analyst with a domestic brokerage.

RIL moved on its backward integration story in textiles in a big way over three decades ago when its main raw material was polyester textile. From there, it moved into manufacturing polyester filament yarn, which in turn comes from petrochemicals. That set the process in motion for the foray into petrochemicals and later plastics. From there, it went further into petroleum refining and later exploration of oil and gas. Now, it is to move forward in the textile business.

“The margins in the textile industry have been under pressure for a while now and clearly, RIL is looking at retail as a way to expand that. They see an opportunity in creating a value chain in textiles,” thinks Choksey.

Courtesy: https://www.businesstoday.in/latest/corporate/story/mukesh-ambanis-reliance-is-not-spinning-the-yarn-in-textiles-its-making-bold-moves-346970-2022-09-12

Copyrights © 2026 GLOBAL TEXTILE SOURCE. All rights reserved.