Category: General

Country: United States

Q2 performance driven by a rise in transactions

By Jennifer Marks

Editor in Chief

21st August, 2024

Minneapolis – Discretionary trends improved for third consecutive quarter at Target Corporation.

Each of the discounter’s core categories saw growth in the quarter, executives said during this morning’s Q2 review call with investors. However, combined discretionary comps were down just slightly.

Women’s apparel and beauty were the standouts during the period ended Aug. 3. Home trends were softer than apparel, which comped up 3%. Within home, the top categories were kitchen as well as value-priced items such as candles, decorative accessories and throw pillows.

Total company comps rose 2.0% (vs. -5.4% in last year’s Q2), with a 3.0% increase in transactions offsetting a -0.9 dip in average transaction amount. In-store comps inched up 0.7% (vs. -4.3% in the year-ago quarter), and digital comp climbed 8.7% (vs. -10.5% YOY).

Target is now looking to Back-to-School, Back-to-College and Halloween to propel Q3 sales.

“Consumers continue to focus on value as they work hard to manage their family budgets,” said Brian Cornell, chair and CEO. “We’re going to continue to play offense.”

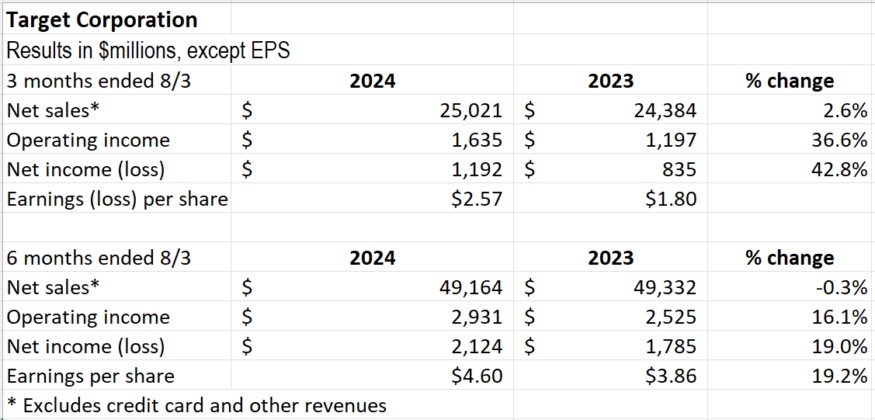

During the second quarter, Target beat expectations on both the top and bottom lines.

Net sales rose 2.6% to $25.0 billion. Net income jumped 42.7% to $1.2 billion, or $2.57 per diluted share.

Despite the strong performance, Target is maintaining a prudent sales outlook for the full fiscal year. Per its previous guidance, the company still expects FY comps to range from flat to up 2%. Today, the company said it now expects comps to land in the lower half of that range.

However, Target raised its profit guidance for adjusted EPS to $9.00-$9.70. The previous forecast fell in the range of $8.60-$9.60.

Courtesy: Hometextilestoday.com

Copyrights © 2025 GLOBAL TEXTILE SOURCE. All rights reserved.