Category: General

Country: India

Region: Asia Pacific

Government initiatives like signing of FTAs with multiple countries & stability in export incentive policy to provide robust opportunities for Indian exporters.

By SI Reporter, Mumbai

3 min read

Last Updated: Aug 21 2023 | 10:50 AM IST

Shares of textiles companies rallied up to 6 per cent on the BSE in Monday’s intra-day trade on expectations of improvement in business outlook. Gokaldas Exports, Indo Count Industries, KPR Mill and Himatsingka Seide were up in the range of 3 per cent to 6 per cent, hitting their respective 52-week highs. In comparison, the S&P BSE Sensex was up 0.21 per cent at 65,087 at 10:32 AM.

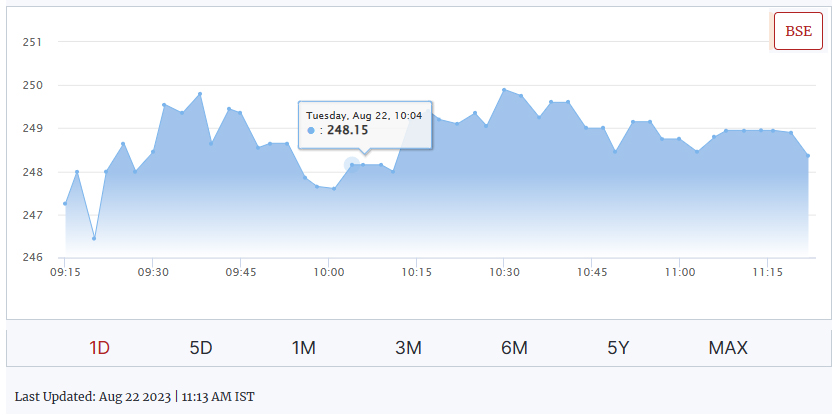

Indo Count Inds.

India’s home textile export market in FY23 was marred by various challenges such as significantly higher domestic cotton prices and excess inventory build-up with the US retailers.

However, the long-term prospect for the industry remains strong with continuing shift of global sourcing away from China, supplier consolidation towards efficient and well-capitalized players, and supply side instabilities in several countries.

Favourable currency, production-linked incentive (PLI), and free trade agreements (FTAs) with key markets should drive the company to a strong future. The India-UK FTA negotiations have made good progress. India is also negotiating FTA with Canada and EU. All of these moves have the potential to open up large markets for preferential trade, according to Gokaldas Exports.

Meanwhile, Himatsingka had reported a consolidated profit after tax of Rs 29.15 crore in June quarter (Q1FY24), on back of strong operational performance. The company had posted a net loss of Rs 54.73 crore in a year ago quarter. Earnings before interest, taxes, depreciation, and amortization (EBITDA) jumped 192 per cent year-on-year (YoY) to Rs 152.09 crore, margin improved 1,449 bps to 22.2 per cent from 7.7 per cent in Q1FY23.

The improved operating performance in Q1FY24 was on the back of improved capacity utilisation levels, softening raw material prices and marginal easing of energy costs. The management said it continue to see progressive improvement on the demand front driven by the company’s expanding client base and growing presence in new markets. Key raw material prices continue to see marginal softening during Q1FY24 and thereby contributing to improved operating margins, the management said.

Currently, the industry is witnessing demand greenshoots as inventory levels at the global retailers are gradually correcting. Furthermore, India has regained its lost market share (for Cotton sheets) in the US from ~ 50 per cent in CY22 to 58 per cent in YTD-23 (Jan-June 2023), ICICI Securities said.

Indo Count Industries too is witnessing incremental business and enhancement in order book position for the upcoming holiday season. The brokerage firm expects volumes to grow by 18 per cent YoY in FY24 to 88 million pieces (capacity utilisation rate 57 per cent). “We expect company to cross 100 million pieces mark by FY25E translating into CAGR of 16 per cent in FY23-25E. With positive operating leverage kicking in and stabilisation of cotton prices, we build in EBITDA margin expansion of 125 bps during FY23-25E (EBITDA CAGR: 19 per cent),” analysts said in stock report.

Government initiatives like signing of FTAs with multiple countries & stability in export incentive policy to provide robust opportunities for Indian exporters. Indo Count through its sizeable capacity is well poised to capture the export opportunity in global home textile trade, the brokerage firm said with ‘Buy’ rating on the stock and 12-month target price of Rs 295 per share.

Courtesy: Business-standard.com

Copyrights © 2025 GLOBAL TEXTILE SOURCE. All rights reserved.