Category: General

Country: United States

Only 15 per cent of US cotton apparel came from China last year, down from 22 per cent in 2019, while imports of cotton textiles from China dropped by 4 percentage points to 27 per cent last year. Photo: Bloomberg

-Last year, China’s share in the US apparel market fell to a decade-low of 23 per cent when measured by value

-The US has effectively banned all products made in part or entirely from cotton made in the Xinjiang Uygur autonomous region, including textiles and apparel

Sidney Leng

Published: 7:15pm, 16 Feb, 2021

The trend of US companies reducing their exposure to China’s textile and clothing suppliers has become a shift that is unlikely to reverse under the Biden administration, with Washington remaining committed to combating forced labour issues, according to trade data and an industry expert.

Last year, China’s share in the US apparel market fell to a decade-low of 23 per cent when measured by value, according to data from the Office of Textiles and Apparel under the US Department of Commerce.

In contrast, the combined market share of China’s major competitors in Asia, including Vietnam, Bangladesh, Indonesia, India and Cambodia, rose to a new high of more than 42 per cent in 2020, up 7 percentage points from year earlier.

Apart from the widespread impact from the coronavirus pandemic and a slew of punitive trade tariffs imposed by Washington on Chinese goods since 2018, a stream of US bans and restrictions on cotton products made in the Xinjiang Uygur autonomous region over its alleged forced labour issue have also played a major role in China’s shrinking shipments of clothing and textiles to the US last year.

"We shall not underestimate the impact of non-economic factors on China’s prospect as an apparel-sourcing destination in 2021"

-Sheng Lu

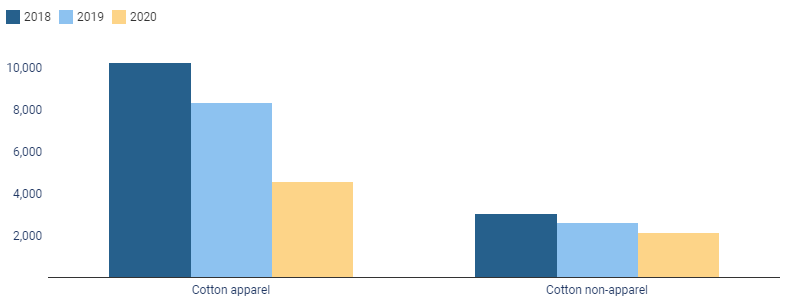

While China’s total textile and apparel exports to the US dropped by more than 30 per cent last year from a year earlier by value, its shipments of cotton related items to the US dropped by nearly 40 per cent, according to the US government data.

Specifically, only 15 per cent of US cotton apparel came from China last year, down from 22 per cent in 2019, while imports of cotton textiles from China dropped by 4 percentage points to 27 per cent last year.

“We shall not underestimate the impact of non-economic factors on China’s prospect as an apparel-sourcing destination in 2021. Notably, the reported forced labour issue related to Xinjiang, China, and a series of actions taken by the US government have significantly affected US cotton apparel imports from China,” said Sheng Lu, an associate professor of fashion and apparel studies at the University of Delaware.

“The new Biden administration has expressed its commitment to improving human rights and labour standards in international trade.

“It is likely that more draconian trade-restrictive measures or even economic sanctions will further change US fashion companies’ calculation about the costs and benefits of sourcing apparel from China in 2021 and beyond.”

China's cotton products imported by the US

In millions USD

Source: The Office of Textiles and Apparel

Earlier last month, the US government issued an order to detain cotton and tomato products produced in Xinjiang at US ports of entry over forced labour concerns. The order applies to all products made in part or entirely from Xinjiang’s cotton and tomatoes, including textiles and apparel.

It is accepted that it is difficult to trace when particular parts have entered a supply chain, but US fashion firms have been treading carefully over the past year between reducing exposure to China’s supply chain and keeping the cost of sourcing low amid the coronavirus pandemic.

China remained the largest source of textile and apparel imports for the US in terms of both quantity and value, with Lu citing China’s fast recovery of production capacity and sufficient local textile suppliers as its main advantage.

In the case of China, US retailers rarely need to worry when placing an order, whereas in other Asian countries, textile products have to be imported, sometimes from China anyway, he added.

“In other words, the relatively complete local textile and apparel supply chain in China may help US fashion companies mitigate the risk of supply chain disruptions during the pandemic,” Lu said.

The US trade data also showed that the sourcing advantage in Asia could not be easily replaced by countries close to the US, even as near-shoring gains popularity during the pandemic.

Measured by value, more than 70 per cent of US apparel imports still came from Asian countries last year, a level that has remained stable for a decade.

"As most US fashion companies do not have the financial resources to invest in building the Western Hemisphere supply chains during the pandemic, a sizeable return of near-sourcing does not seem to be too likely in 2021 either"

-Sheng Lu

The value and the quantity of US apparel imports from United States – Mexico – Canada Agreement (USMCA) and Dominican Republic – Central America Free Trade Agreement (CAFTA-DR) members continued to lose market shares in 2020 as their products offered little advantage in terms of cost and variety over their Asian competitors.

“Under the so-called Western Hemisphere supply chain, USMCA and CAFTA-DR members often rely on textile supply from the US, which, however, also substantially limits the types of apparel items they can produce,” Lu said.

“As most US fashion companies do not have the financial resources to invest in building the Western Hemisphere supply chains during the pandemic, a sizeable return of near-sourcing does not seem to be too likely in 2021 either.”

Courtesy:

https://www.scmp.com/economy/china-economy/article/3121900/us-china-relations-forced-labour-keep-pressure-chinese?follow=265568

Copyrights © 2025 GLOBAL TEXTILE SOURCE. All rights reserved.